Family offices are booming—today, 15,000 FOs manage $5.9 trillion globally (JP Morgan, 2024). Most of these capital allocators are new and they are reshaping how capital flows. Join us to meet them.

Introduction.

If you were born between 1980 and 1995—get ready, because you are about to become the richest generation in history.

Yes, I’m Gen Y, so I’m also concerned. Or at learn I’m hoping to.

That is why this Tuesday I’m gathering 70+ family offices at our New York Family Offices & Investors Summit 2025.

The Great Wealth Transfer. Image: The Atlas Capital.

The phenomenon began in 2022, it should last 15 to 20 years, and it has a name: the Great Wealth Transfer. Right before our eyes, quietly, the world is witnessing the largest transfer of wealth ever recorded in history, as the Baby Boomers—who accumulated fortunes like no generation before them—pass it on to their children and grandchildren.

And here’s the shocking part: $124 trillion will change hands by 2048. That’s a 15-digit number. In the U.S., more than $84 trillion will move directly from Boomers to their heirs. In France, my home country, nearly €7 trillion will circulate in the next 15 years.

By the end of the process, Generation Y will have become the richest generation in history. This is an unprecedented economic, financial, and historical opportunity event.

Our family Offices & Investors Summits are here to help you, GPs of funds or founders of climate & frontier tech companies, to capitalize this opportunity.

Looking At The Macro First.

The Great Transfer will disrupt far more than bank accounts. It will reshape real estate markets, shake the stock markets, boost investments in family businesses, and even influence taxation and public policy. But above all, it signals the death knell of something essential: meritocracy. In 20 years, being rich won’t depend on what you do, but on who your parents are. And that changes absolutely everything.

The Great Transfer didn’t happen by chance. It was predictable, even expected. Demographers and economists have long known the time would come when Baby Boomers would begin disappearing and passing on the immense wealth they accumulated. Boomers, born between 1945 and 1967, are now 58–80 years old, entering a stage of life where wealth transmission accelerates—sometimes through lifetime donations, but mostly through inheritance.

The transfer began in 2020 and will last 20 years, peaking around 2037.

Why so massive? First, Boomers grew up during strong economic growth and asset booms in real estate and stocks, amassing more wealth than any generation before. Second, longer lifespans delayed inheritances, causing them to accumulate to unimaginable amounts.

Some Numbers To Deep Dive

Numbers? In the U.S., total household wealth is about $190 trillion, with $124 trillion—65%—to be passed on by 2048. Of that, $105 trillion will go to heirs, and $18 trillion to charities. Wealth is concentrated: fewer than 2% of households will account for over half of transfers. Real estate alone is staggering: Boomers own 37% of primary residences and 58% of rental properties in the U.S. All of it will change hands. They also own nearly $8 trillion in private business equity and huge stock portfolios.

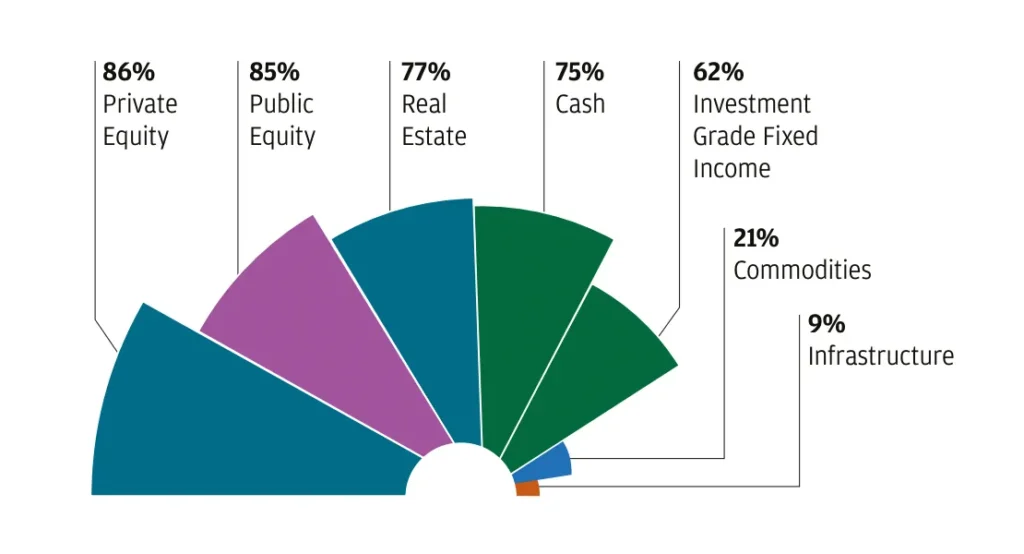

Asset allocations, Source: JP Morgan Family Offices Report, 2024

Family offices increasingly tilt toward alternatives—now accounting for nearly half of portfolios—as they seek higher returns and diversification. Public equities and fixed income remain important for liquidity, while real estate and private credit provide stability and yield.

France is smaller but still huge: Boomers own about a quarter of national wealth, with €5–8 trillion expected to change hands in 15–20 years. Similar dynamics exist in the UK (£5.5 trillion), Canada, Australia, Germany, and Italy.

Who inherits? Gen X (1965–1980) will get around $39 trillion, Gen Z about $15 trillion—but Millennials (1980–1997) will get the largest slice: over $46 trillion. They’ll become the richest generation in history.

Expectations are enormous: over half of Millennials expect an inheritance within 5 years, and even 40% of Gen Z do too.

Investment Lenses & Tangible Examples

How will they use it? Millennials and Gen Z are already leaning toward alternative investments: private equity, startups, direct company ownership, sustainable assets, crypto, impact investing. Family offices are booming—today, 15,000 family offices manage $5.9 trillion globally. These structures are reshaping capital flows and competing with banks.

At our Family Offices & Investors Summit in New York next week, we’ll showcase 4 concrete examples of the kinds of alternative investments this next generation of family offices is already pursuing and investing in:

Example 1: WIF.foundation — a non-profit working in blue carbon ecosystems (mangroves, seaweed, seagrass) to generate high-quality, VERRA-certified carbon credits while reinvesting 50% of net income into local community development. Their impact scale is unique: ~120 million mangrove trees planted and protected with a 90% survival rate, and credits rated AA by BeZero. Learn more about their work by attending their workshop in New york on September 25th.

Reachout to WIF foundation, Kim here.

For family offices, WIF aligns strongly with the impact / sustainability sleeve of portfolios: nature-based solutions with long time horizons, higher project development risk, but reputational and social co-benefits that traditional PE cannot deliver. It represents the archetypal “alternative within alternatives”—a play where capital delivers both legacy and liquidity.

Example 2: e-Zinc — a cleantech company commercializing zinc-air energy storage capable of multi-day duration and extreme climate performance (−30 °C to +60 °C). Using abundant, recyclable materials (Zinc), their systems claim to be up to 80% cheaper than lithium-ion for long-duration use cases. Founded in 2012, e-Zinc has raised ~$60M and is backed by renowned investors including Toyota Ventures, Mitsubishi and even the famous astronaut Chris A. Hadfield. Its 42,000 sq ft pilot facility in Ontario, Canada and field projects with Toyota Tsusho and the California Energy Commission signal commercial scale.

Reachout to e-Zinc founder, James here.

For family offices, e-Zinc fits into the “high impact / mid risk / mid horizon” allocation—often ~5–10% of portfolio reserved for deep tech. It carries high failure probability but asymmetric return potential if it becomes a backbone of the energy transition.

Example 3: WattMonk — a solar engineering and permit services platform founded in India in 2019, now serving developers and installers in the U.S. and Australia. Post Revenue and high margins, WattMonk grew 111% in FY 2023 and employs 300+ staff. Its model: fast, cost-efficient technical and CAD services that replace in-house teams, potentially leveraging AI/ML for workflow automation.

Reachout to WattMonk founder, Ankit here.

For family offices, WattMonk is a lower-capital, service-driven play within the “climate infrastructure enablement” theme. Compared to e-Zinc or WIF, the upside might be less strategic, but risk is lower and scalability depends on client concentration, recurring revenue, and tech differentiation. Within FO allocations, it falls into the smaller slice of early-stage climate platforms that can generate stable returns without billion-dollar capex.

Each of these examples illustrates how family offices are reallocating wealth into new technology frontiers—whether nature-based credits, deep tech, climate services, or land-backed natural capital.

The Adaptive Capitalist Playbook

But socially, there’s a darker side. The Great Transfer won’t enrich everyone—it will widen inequality. In France, over half of Millennials won’t inherit anything. Meanwhile, the richest 10% already own over half the nation’s wealth. Inheritance will outweigh work as the driver of wealth.

Annual inheritances and donations will soon surpass pensions (€300B+). That means heirs will weigh more in the economy than active workers.

- 📈 Signal: $124 trillion in transfers by 2048.

- 🌍 Risk: Wealth dynasties deepen inequality, freezing social mobility.

- 💡 Move: Track where heirs are allocating—not just into safe real estate, but into alternatives assets in climate and frontier tech.

Note: This leads to a society of heirs—a kind of return to feudalism, where family name matters more than effort or education. Social mobility stalls, entrepreneurship is discouraged, inequality deepens. Unless taxation redistributes, wealth will freeze in dynasties.

And inheritances often arrive late—around age 60—meaning wealth stays concentrated in older age groups rather than supporting younger generations.

Our Upcoming Family Offices Summits

So while the Great Wealth Transfer promises a flood of liquidity and economic opportunities, paradoxically it also accelerates a return to an old system: to be rich, you must be old and well-born. Whether society will adapt—or even accept it—remains to be seen.

For our readers building the Adaptive Economy, the choice is clear. Either wait for the inheritance—or be part of the structures, deals, and gatherings where that wealth will be deployed.

Adaptation is not optional. Connecting directly with family offices is capital’s final frontier.

🌍 A special thank you to our Gold Sponsors mentioned in this article for making these conversations possible during our New York Summit. Their support allows us to keep bringing together the investors, founders, and leaders shaping tomorrow’s economy.

📅 And this is just the beginning. Join us at our upcoming Family Offices & Investors Summits:

Each gathering is another step in building the coalitions that will direct billions toward frontier tech, climate adaptation, and resilient wealth creation.

Will you be in the room with us?

Fight the Good Fight.