While traditional capital hesitates, the next great fortunes are being built in energy transition, industrial AI, and resilience. Connect with decision-makers and family offices owners with us.

I. The Changing Landscape – Understanding Our Moment

The investment landscape is experiencing profound transformation. We witness persistent inflation, evolving debt dynamics, and geopolitical shifts that challenge traditional approaches. While global markets navigate uncertainty, forward-thinking investors recognize this as a defining moment for strategic capital deployment.

The traditional investment paradigm—heavily weighted in public equities and conventional fixed income—faces headwinds from market volatility and the gradual economic contraction characteristic of a “slow recession.” This environment, marked by sustained declines in consumer and business confidence, requires a more nuanced approach to wealth preservation and growth.

Many established players maintain a cautious “wait and see” posture, focusing on quarterly performance while missing longer-term structural shifts. Their approach often emphasizes compliance over innovation, creating a gap between stated sustainability goals and actual capital allocation. This conventional wisdom, while comfortable, may not be sufficient for navigating the complexities ahead.

Perhaps most concerning is the challenge of intergenerational wealth transfer. Current economic turbulence highlights how wealth accumulated over decades can erode without proper succession planning and strategic foresight. The most successful families understand that preserving legacy requires both meticulous planning and the courage to embrace new paradigms

II. Our Vision: The Adaptive Economy Framework

Since our founding in 2022, Atlas has championed a different approach. As the official, renowned family office and investors gathering, we’ve built a community of forward-thinking capital allocators who understand that true wealth preservation requires active adaptation.

More details about our San Francisco Family Offices & Investors Summit here

Our gathering in San Francisco last April aboard the USS Hornet for Earth Day 2025 exemplified this vision, uniting 280+ family offices, investors, and builders representing over $22B+ in capital.

This historic aircraft carrier, once a symbol of exploration and achievement, became a powerful venue for advancing climate, energy, and frontier technology solutions. The event demonstrated how connecting the right stakeholders can accelerate innovation and create new investment categories.

The Adaptive Economy, which we’ve been developing since 2020, offers a framework for understanding and capitalizing on our rapidly changing world. Rather than simply reacting to volatility, this approach identifies fundamental, non-negotiable shifts that will shape the coming decades and positions capital to build the infrastructure, technologies, and systems required for sustainable prosperity.

This philosophy centers on “monetizing the inevitable”—recognizing that certain transformations in energy, technology, and climate adaptation are not matters of if, but when. In an era of rapid technological advancement, geopolitical realignments, and environmental challenges, success increasingly depends on anticipating these changes and positioning accordingly.

The current economic environment, while challenging for traditional portfolios, creates exceptional opportunities for sophisticated investors. This period enables acquisition of quality assets at favorable valuations, access to improved lending conditions, and the ability to capitalize on emerging trends less correlated with broader market downturns. For those with strategic vision and appropriate liquidity, today’s challenges become tomorrow’s competitive advantages.

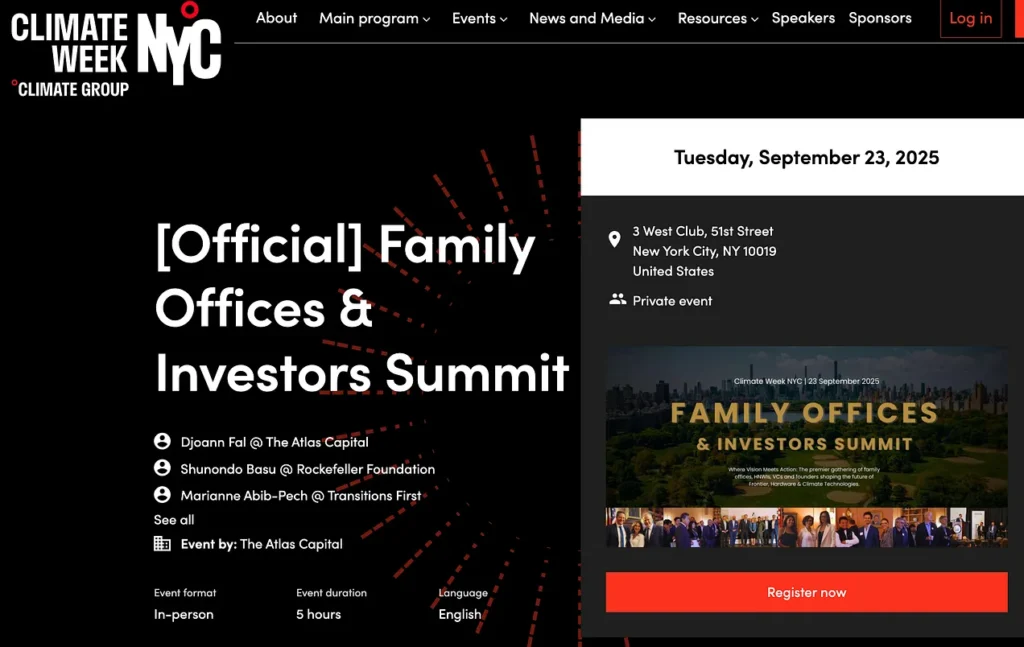

III. Announcing the New York Family Office & Investors Summit: Our Premier Gathering

We’re pleased to announce the New York Family Office & Investors Summit, continuing our mission to advance “a new operating system for The Atlas Climate & Frontier Tech Coalition.” Building on the success of our USS Hornet gathering, this summit brings together the most innovative minds in family office investing, from established generational wealth to dynamic new capital.

Picture: San Francisco Family Offices & Investors Summit by The Atlas Coalition

Our previous event demonstrated the power of thoughtful connections—transforming discussions into actionable partnerships and creating new investment opportunities. Attendees included global leaders such as representatives from the Bill & Melinda Gates Foundation’s $75B portfolio focused on health and climate solutions, executives from Genting Singapore’s multi-billion integrated resort group, and leaders from TotalEnergies’ $150B global energy transformation. The gathering also featured decision-makers from Singtel’s $40B telecom infrastructure, Thailand’s Charoen Pokphand Group with $70B+ revenues spanning agri-food to energy, and PTT’s $80B energy operations with comprehensive net-zero commitments. All were united by a shared commitment to building sustainable, profitable solutions for global challenges.

This summit addresses the evolving landscape of energy policy, trade dynamics, and technological advancement. We believe that access to climate resilience and AI adaptation should be broadly available, not limited to a select few. Like the USS Hornet’s historic mission of bringing heroes safely home, our gatherings serve to launch the next generation of solutions for resilience, adaptation, and shared prosperity.

Summit Programming: Five Strategic Panel Discussions

Our agenda specifically addresses the foundational opportunities within the Adaptive Economy:

Next-Gen Energy & Industrial Decarbonization: SAFs, Nuclear, and other Inevitable New Energy Markets:

This session explores how breakthrough energy innovations are being financed and scaled to meet both climate goals and exponential AI energy demands, featuring:

- Nicholas Flanders, CEO & Co-Founder of Twelve, the $1B+ unicorn converting CO₂ into sustainable aviation fuels with partnerships spanning NASA and Mercedes-Benz;

- Jessie Lam, Co-Founder & General Partner at Alinea Ventures managing $100M+ backing frontier technologies;

- and Warrick Matthews, CEO of Tokamak Energy, leading the $250M+ funded fusion venture targeting >1GW commercial reactors in the 2030s.

LP & GP Discussion: Perspectives on Energy, AI & Adaptation Investment from North America to South East Asia:

A candid dialogue on how global capital flows and most recent strategic rationale behind resilience-focused portfolios from institutional and family office perspectives, featuring:

- Marianne Abib-Pech, LP in several funds, former $20B Shell Aviation CFO now managing a single family office targeting the $3T industrial tech market;

- Suzanne DiBianca, LP in several funds, EVP of Corporate Relations at Salesforce leading $500M climate commitments;

- and Martijn Lopes Cardozo, Partner at Regeneration.VC backing next-gen materials in the $4.5T sustainable consumer transition.

To deep dive on this topic, refeer to my latest newsletter here on The Adaptive Economy

Family Offices & HNWIs: Asset Allocations Amid the New American Dynamism: This discussion examines how geopolitical dynamics and industrial policy are reshaping family office allocation strategies, featuring:

- Jocelyn Matyas, LP in several funds, Head of Climate Impact at Cisco Foundation overseeing part of Cisco’s $100M+ climate portfolio;

- Nick Laidlaw, CEO of Worldview International Foundation leading blue carbon initiatives across Asia;

- Scott Ryan, Former banker at Merrill Lynch, co-Founder of Investature, supports retirement funds on capital deployment towards climate tech & sustainable industries.

- and Yuri Naumov Corbera, LP in several funds, Global Family Office Accounts Manager at Bouygues Construction ($40B+ infrastructure group) building strategic partnerships for resilient urban development.

The Built Environment Reimagined: AI & Climate Resilience for Future Cities: This panel demonstrates how AI, advanced materials, and next-generation mobility are transforming urban infrastructure, showcasing:

- Timothy McCaffery, LP in several funds, Director of Technology and Science Investments at Siam Cement Group ($18B+ industrial giant) leading sustainable construction innovation;

- Max Gerbut, Founder of Haus.me developing fully self-sufficient smart homes reducing energy use by 70%;

- Gustavo Boriolo, LP in several funds, Innovation Investment lead at Bouygues Construction pioneering resilient housing and urban adaptation;

- and Ben Dusastre, Co-Founder of Harbinger Motors reimagining the $200B+ commercial fleet electrification market.

Picture: San Francisco Family Offices & Investors Summit by The Atlas Coalition

💼 Investing in Frontier & Climate Tech: Insights for Success from Seed to Exit:

Featuring:

- Benjamin Tinq (Marble) – Founder bringing next-generation industrial solutions for the energy transition and frontier tech manufacturing, positioned in markets worth over $500B+ by 2030

- Paul Burgon (Exit Ventures) – Partner at growth-focused investment firm guiding climate and frontier companies through scaling and exit pathways, with a portfolio representing over $2B+ in enterprise value

- Sarthak Tiwary (Technoculture) – Founder innovating at the intersection of healthtech and frontier science, targeting the $1.5T+ global healthcare and diagnostics market

- Moderator: Ayub Ansari (Carlyle Group – Anthesis) – Investor steering Anthesis initiatives across energy transition and industrial tech, part of Carlyle’s $425B+ AUM platform

Beyond formal sessions, the summit includes structured networking designed to facilitate meaningful connections. We’ve learned that the most successful partnerships often emerge from unexpected conversations, bringing together complementary expertise and shared vision.

IV. Join Our Community: The Future of Strategic Investing

Investment success increasingly depends not only on capital allocation decisions but on access to information, relationships, and opportunities. The New York Family Office & Investors Summit represents an opportunity to engage with peers who share a commitment to building sustainable, profitable solutions for global challenges.

As market volatility creates hesitation among some investors, sophisticated capital allocators recognize the opportunity to acquire quality assets, access favorable terms, and position for the next cycle of growth. Family offices, with their longer investment horizons and flexible structures, are uniquely positioned to capitalize on these market conditions.

Expanding Access To The First 50 Family Offices Through WeTheAtlas:

Do you know the secret that transforms millionaires into billionaires? A clue: this asset class outperformed the S&P500 for the past 20 years.

Until today, private equity has been locked behind walls for most people where only wealthy could afford their minimum entry tickets at hundreds of thousands of dollars.

WeTheAtlas democratize the access to the world best performing private equity, VC funds and private companies starting only 10,000$.

WeTheAtlas isn’t a fund, an event, or a website.

It’s a capital operating system for the most important asset class of the decade: energy, robotics and climate resilience.

With retail investment inflows exceeding $2T since 2020, yet access to private companies (especially in frontier & climate technology) remaining essentially unavailable to individual investors, WeTheAtlas bridges this critical gap.

The platform offers curated opportunities including special purpose vehicles featuring companies from established VC pipelines, access to funds holding Series A+ companies with demonstrated traction, and diversified fund-of-funds models spanning climate, energy, and robotics sectors.

We invite you to join this community of forward-thinking investors, to engage with breakthrough technologies before they become mainstream, and to participate in building the infrastructure for long-term prosperity.

The most successful investors act decisively when opportunity and preparation intersect.

Our event is official partner of the New York Climate Week, every years, since 2023.

Join us at the New York Family Office & Investors Summit and help shape the future of strategic investing.

Together, we build tomorrow.